Amortization expense formula

You can even. Whereas Amortization is used to expense the Intangible Assets of your business over their useful life.

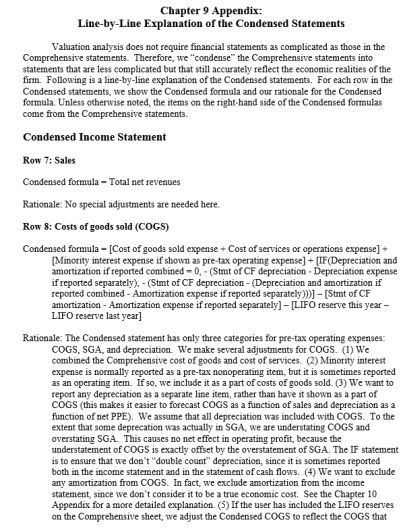

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Interest expense and taxes.

. A standard formula might look like this. Colgate SEC Filings We note that the EBIT of Colgate in 2016 was 3837 million. In business amortization refers to spreading payments over multiple periods.

Amortization expense is charged debited to the PL expense account with an offsetting credit directly in the intangible asset account. A portion of each payment is for interest while the remaining amount is applied towards the. Meaning Formula and Example.

How to Create a Cost Leadership Strategy. Depreciation Amortization - the charge with respect to fixed assets intangible assets that have been capitalised on the balance sheet for a specific accounting period. The formula for interest expense can be expressed as follows with those three pieces of information.

Often abbreviated as OPEX operating expenses include rent equipment inventory. The schedule shows the remaining balance still owed after each payment is made so you know how much you have left to pay. How to calculate operating expense.

In contrast depreciation is credited to accumulated depreciation a contra-asset. The term is used for two separate processes. Now let see another example to find ending inventory using FIFO LIFO and Weighted average method.

Ending inventory 50000 20000 40000. The amortization expense can be calculated using the formula shown below. Income tax expense - sum of the amount of tax payable to tax.

Net working capital 7793 Cr Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. Amortization Formula in Excel With Excel Template Amortization Formula. COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor.

An operating expense is an expense a business incurs through its normal business operations. Ending inventory 30000 Inventory Formula Example 2. Ten financial terms for small business.

The EBITDA Earnings before interest tax depreciation and amortization formula as the name indicates is the calculation of the companys profitability which can be derived by adding back interest expense taxes depreciation amortization expense to net income. The principal is the current loan amount. Whereas lease expense which is the combined interest and amortization expense of an.

When calculating interest expense for a finance lease the outstanding obligation is equal to the previous periods ending lease liability balance. The accumulated amortization account appears on the balance sheet as a contra account and is paired with and positioned after the intangible assets line itemIt is not common to report accumulated. The earnings before interest taxes depreciation and amortization EBITDA formula is one of the key indicators of a companys financial performance and is used to determine the earning.

In this case you will calculate monthly amortization. Net Working Capital Total Current Assets Total Current Liabilities. What is the EBITDA Formula.

Capitalized Cost Annual amortization expense Estimated useful life. Gather the information you need to calculate the loans amortization. To calculate operating expense you simply add all of your operating expenses together.

Amortization and depreciation are the two main methods of calculating the value of these assets. The effective interest rate is a method used by a bond buyer to account for accretion of a bond discount as the balance is moved into interest income and to amortize a. The rate of depreciation is 50 and the salvage value is 1000.

An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. It is a systematic and rational allocation of cost rather than the recognition of market value decrement. Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. An amortization schedule is a list of payments for a mortgage or loan which shows how each payment is applied to both the principal amount and the interest. For example suppose company B buys a fixed asset that has a useful life of three years.

Conceptually EBITDA represents the normalized core earnings of a company and neglects the effects of financing items eg. Amortization Formula Table of Contents Amortization Formula. It is done to improve the long term profitability.

Youll need the principal amount and the interest rate. To create an amortization schedule using Excel you can use our free. In the latter case it refers to allocating the cost of an intangible asset over a period of time for example over the course of a 20-year patent term 1000 would be recorded each year as an amortization.

Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. To calculate amortization you also need the term of the loan and the payment amount each period. Amortization of loans and amortization of assets.

Under the straight-line method an intangible asset is amortized until its residual value reaches zero which tends to be the most frequently used approach in practice. The expense would go on the income statement and the accumulated amortization will show up on the balance sheet. Amortization of Intangible Assets Formula.

Furthermore you can use various methods to calculate the amortization expense to be charged to the intangible asset. The formula for the operating expense can be derived by using the following steps. The cost of the fixed asset is 5000.

The expense amounts are then used as a tax deduction reducing the tax liability of the business. Firstly determine the COGS of the subject company during the given period. Effective Interest Method.

EBITDA an abbreviation for earnings before interest taxes depreciation and amortization is a non-GAAP proxy for a companys normalized pre-tax operating cash flows. Amount paid monthly is known as EMI which is equated monthly installment. Net working capital 106072 98279.

The EBIT above does contain noncash items like Depreciation and Amortization Restructuring costs Restructuring Costs Restructuring Cost is the one-time expense incurred by the company in the process of reorganizing its business operations. Debit Amortization Expense - 10000 Credit Accumulated Amortization - 10000. In this article you will see it described as both an operating expense and applied separately from other operating expenses.

The formula for amortization is. It also refers to the spreading out. Luckily you do not need to remember this as online accounting softwares can help you with posting the correct entries with minimum fuss.

Amortization expense is the write-off of an intangible asset over its expected period of use which reflects the consumption of the asset.

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Ebit Vs Ebitda Differences Example And More Financial Modeling Bookkeeping Business Accounting Education

Ebitda Formula Accounting Education Finance Printables Saving Money Budget

Accounting Principles Money Management Advice Accounting Principles Accounting Education

Pin On Financial Education

Accounting Class Help Com Accounting Classes Accounting Financial Accounting

The Freedom Formula How To Turn 244 000 Into 1 4m In 14 Years Investing Architect Investing Debt Service The Freedom

Ifrs 16 Transition Series For Lessees Example 2 Transitional Amortization Schedule Journal Entries

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

Office Supplies Inventory Spreadsheet Profit And Loss Statement Statement Template Income Statement

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Times Interest Earned Formula Advantages Limitations In 2022 Accounting And Finance Financial Analysis Accounting Basics

Myeducator Business Management Degree Accounting Education Accounting

Pin On Business Iders

Accounting Equation Chart Cheat Sheet In 2022 Accounting Payroll Accounting Accounting Basics